Federal Budget – May 2024

The positioning of tonight’s Federal Budget was (unsurprisingly) similar to last year—easing pressures today and investing in a better future. Despite better-than-expected economic outcomes, there is still a level of weariness, given persistent heightened economic uncertainty globally and locally. The key proposals broadly fall into the categories of easing cost-of-living pressures, building more homes, investing in a Future Made in Australia, and strengthening Medicare and the broader care economy.

Superannuation related proposals were (again) limited, and primarily confirmed proposals announced earlier.

Economic update

Balancing Act Budget

This Federal Budget comes after a series of interest rate increases through 2022 and 2023 from the Reserve Bank of Australia (RBA), amidst an economy that is slowing, and at a time when many households are feeling the strain. With that, this Budget attempts to provide some relief without adding inflationary pressure.

Budget headline numbers

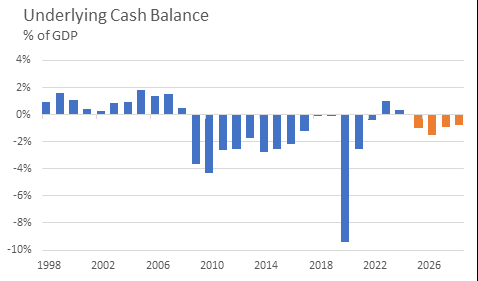

The 2023-24 Financial Year (FY24) is set to see a second successive year of small surpluses, with the Treasury projecting a $9 billion (0.3% of GDP) surplus for the year. This is an improvement from the small deficit that was forecast in the Mid-Year Economic and Fiscal Outlook (MYEFO) last year, as the economy has performed better than expected. This contrasts to many other developed nations, that have been running sizeable Budget deficits. For example, the United States is currently running fiscal deficits equal to 6% of GDP.

Looking ahead, the Treasury expects the budget to move back into deficits of around 1% per year from FY25 onwards as the chart below illustrates.

Source: LSEG Datastream, Australian Treasury May 2024 Budget. Orange bars reflect Treasury projections.

Key measures set to shape the economy

There are three key policy announcements to highlight:

- Modified Stage Three tax cuts are set to come into effect on 1 July 2024. The changes now mean that lower-income households will receive a tax cut and will support consumer spending (given lower income households have higher marginal propensity to consume).

- Development of the Future Made in Australia program is a response to some of the industrial policy seen in other parts of the world (for example, the Inflation Reduction Act in the United States). The aim of the program is to streamline, encourage and facilitate private sector investment in Australia. This will involve funding of $22.7 billion over the next 10 years, but there are also plans to attract more global and local capital to this effort. One of the major focuses is on renewable energy, which is a focus for some private asset managers.

- Some modest cost-of-living relief for households and eligible small businesses, particularly with energy bills. There is also some support for renters, with the Commonwealth Rental Assistance scheme extended.

We don’t expect the tax cuts and other measures to have much of an inflationary impact.

Fiscal impulse and inflation

An important concept in economics is the fiscal impulse, which looks at year-on-year change in the Budget balance. If a government is running a bigger deficit relative to last year, that means that the public sector is adding to GDP growth. In the chart above, you can see the fiscal impulse through the change in the bars—a downward move from year-to-year points to a positive fiscal thrust. The fiscal impulse for FY25 is estimated to be a 1.3 percentage point boost to GDP (in nominal terms), which is supportive but comes at a time when growth is already running below trend. This is important, as above-trend growth runs the risk of accelerating inflation.

More broadly, we expect that the Australian economy will slow through 2024 and inflation is likely to reach the RBA’s inflation target range of 2% to 3% sometime in 2025. Recession risk is lower than it is in other parts of the world, given the strong migration profile and less aggressive policy from the RBA.

Economic and fiscal outlook

The Treasury has a similar profile for economic growth to the RBA and our own, with real GDP growth of around 1.5% this year and 2% the year after. It is notable that the Treasury has a faster return to the inflation target than the RBA currently sees, and that is associated with a more rapid pick-up in the unemployment rate. We tend to lean towards the RBA’s expectations that the path might be a bit slower.

Like previous years, there remain structural challenges with the fiscal situation. Namely, spending on the National Disability Insurance Scheme (NDIS) and aged care are projected to outpace revenue and other spending areas. It should be noted that the expected long-term growth rate for the NDIS (and interest costs) has come down, which is an encouraging signal, but it is still outpacing revenue. This sees a projection of Budget deficits in the later years of the projections. However, we don’t think this puts Australia’s credit rating at risk and expect the AAA status to be reaffirmed. This means that Australian government debt will remain of the highest quality, which means demand for Australian Treasuries will remain robust.

Australia’s net debt situation remains quite low relative to the developed world, with the Treasury projecting net debt to reach 21.9% of GDP in FY28. The Australian Government’s net interest expense is expected to average 0.5% of GDP over the next 2 years—to put this in comparison, the US government is spending about 2.4% of GDP on interest costs.

Implications for asset classes and portfolios

Firstly, to the extent that this Budget does provide a bit of support to the economy (through the broader tax cuts and modest cost-of-living relief), this bolsters the growth prospects for the Australian economy. This should flow through to better earnings growth and this, along with the fact that Australian equities are attractively valued relative to global equities, suggests that Australian equities should perform quite well.

Secondly, we will be closely monitoring the response of consumer spending as the tax cuts commence. Our base case is that these will not prove inflationary, but we remain vigilant to those risks. We have thought it unlikely that the RBA will find itself having to raise interest rates again, and we find nothing in this Budget to change that view. We think Australian Government bonds look attractive on valuations, with our fair value estimate for the Australian 10-year bond yield currently 0.5% below current levels, but believe there are more attractive opportunities in global fixed income.

Finally, the support to growth and our expectation that inflation will come down slower than the Treasury points to potential appreciation in the Australian dollar. We think that the RBA will likely lag other major central banks in cutting interest rates, given our inflation cycle is lagging the rest of the world (influenced largely by Australia re-opening post-COVID after much of the Northern Hemisphere). Additionally, data from the Commodity Futures Trading Commission shows that traders are betting against the Australian dollar, which lowers the hurdle for upside surprise. Our estimate of fair value for the Australian dollar is around 70 cents.

Superannuation update

Super on Paid Parental Leave

The Government has confirmed its previously announced intention to pay superannuation on Commonwealth Government- funded Paid Parental Leave (PPL) for parents of babies born on or after 1 July 2025.

The superannuation payments will be made annually to individuals’ super fund accounts from 1 July 2026.

This initiative is aimed at reducing the impact on the superannuation balances of parents taking career breaks to support young children.

Stage 3 tax cuts

The Government legislated to modify the Stage 3 income tax cuts, meaning more individuals will see their income tax reduce from 1 July 2024.

For individuals with a reduced marginal tax rate, this may reduce the tax benefit from making voluntary concessional (or pre-tax) superannuation contributions and so there may be an advantage in considering bringing forward these contributions into the year ending 30 June 2024.

More broadly, the additional disposable income due to the upcoming tax cuts could mean individuals are able to consider starting to make (or increase) voluntary concessional contributions in future years to further improve their retirement balances.

Other Changes from 1 July 2024

As no amendments were announced in the Budget, the following changes will occur as scheduled from 1 July 2024:

- The Superannuation Guarantee rate will increase from 11% to 11.5% (and is legislated to increase again on 1 July 2025 to 12%).

- The preservation age (i.e. the age an individual can generally access their super) will become 60 for all Australians, due to the transition period coming to an end

The Australian Taxation Office (ATO) recently released details of the various thresholds that will apply for FY25.

Of note is that the contributions caps will increase—the concessional contributions cap will increase from $27,500 to $30,000 and the non-concessional contributions cap will increase from $110,000 to $120,000 (four times the concessional cap). The concessional contributions cap is indexed to wages (Average Weekly Ordinary Time Earnings or AWOTE) in increments of $2,500 and there was no increase last year. Special arrangements continue to be available for ‘unused’ amounts from previous years.

The general Transfer Balance Cap (the maximum a person can transfer to a tax-free pension product) will remain at $1.9 million. It is indexed to the Consumer Price Index (CPI) in increments of $100,000 and increased last year.

Additional funding to bolster super system integrity

The Government announced a number of measures to further improve compliance, collaboration and safety of the super eco-system. These include:

- $187.4 million to bolster the ATO’s information, communication and fraud protection technologies to prevent fraudulent attacks on the tax and super system. The funding will also support victims of fraud and cybercrime.

- $60 million to support employer and employee representatives of the small business sector in particular to engage the Government on reforms, including payday super (effective start date 1 July 2026) and other recent workplace relations changes.

- $2.7 million to support the SuperStream Gateway Governance Body to manage the integrity of the Superannuation Transaction Network, a system that allows participants to transfer contribution data between employers and super funds.

- Recalibrating the Fair Entitlements Guarantee Recovery Program, to pursue unpaid superannuation entitlements owed by employers in liquidation/bankruptcy from 1 July 2024.

- $206.4 million to improve data capabilities, modernisation of systems and cyber security of the Australian Prudential Regulation Authority (APRA) and Australian Securities and Investments Commission (ASIC) across their supervision remit, including superannuation—although this is partially funded by industry levies paid to APRA and ASIC (ultimately funds, organisations and members).

Further freeze on deeming rates

The Government announced that the deeming rates will be frozen at the current rates for an additional 12 months to 30 June 2025.

Deeming rates are used in the ‘income test’ calculation to assess the amount of Government Age Pension and other income support an eligible person may be entitled to. The current deeming rates generally follow the direction of the interest rates in the economy and reached historic lows in early 2020. The extension of the current deeming rates can be seen as a win for current retirees and those receiving income support.

Cost-of living relief measures

The Government announced a number of cost-of-living relief measures, which can impact household budgets and therefore could affect decisions relating to super contributions, retirement and drawing down income in retirement. The proposed measures include:

- Increase in the Commonwealth Rent Assistance maximum rates by 10% on top of regular indexation, to be effective 20 September 2024. This is in addition to the 15% increase in the maximum rate that was put through in September 2023.

- Power bill relief – For the year from 1 July 2024, a $300 rebate for every household and $325 for eligible small businesses.

- Cheaper medicines – A one year freeze on the maximum Pharmaceutical Benefits Scheme (PBS) patient co-payment for Medicare card holders and a five-year freeze for pensioners and other concession cardholders.

- Higher Education Loan Program (HELP) relief – The Government will cut $3 billion in student HELP debt via changes in indexation rules.