Federal Budget: March 2025

It seems the 2025-26 Federal budget has been calibrated for an election, with additional measures to ease cost-of-living pressures. Along with the pending election, there is the global uncertainty with elevated trade tensions. We think these bigger issues are more important for investment portfolios than the Budget measures.

The key proposals are all relatively small compared to previous years:

- a reduction in the lowest tax rate of 1% in the 2025-26 (FY26) and 2026-27 Financial Years (FY27)

- the extension of the energy bill rebate to FY26 (but at a lower rate)

- a reduction in the cost of medicines under the Pharmaceutical Benefits Scheme (PBS).

There were no superannuation-related proposals in the Budget this year.

Pre-election sweeteners

The Federal Budget comes amid a backdrop of elevated uncertainty with global trade policy and a pending election. With this backdrop, the forecasts should be heeded with a bit of caution. The theme of this Budget, in part motivated by the upcoming election, is cost-of-living relief—namely a surprise announcement of tax cuts, along with the extension of the energy rebate and a reduction in the cost of medicines.

The numbers that matter

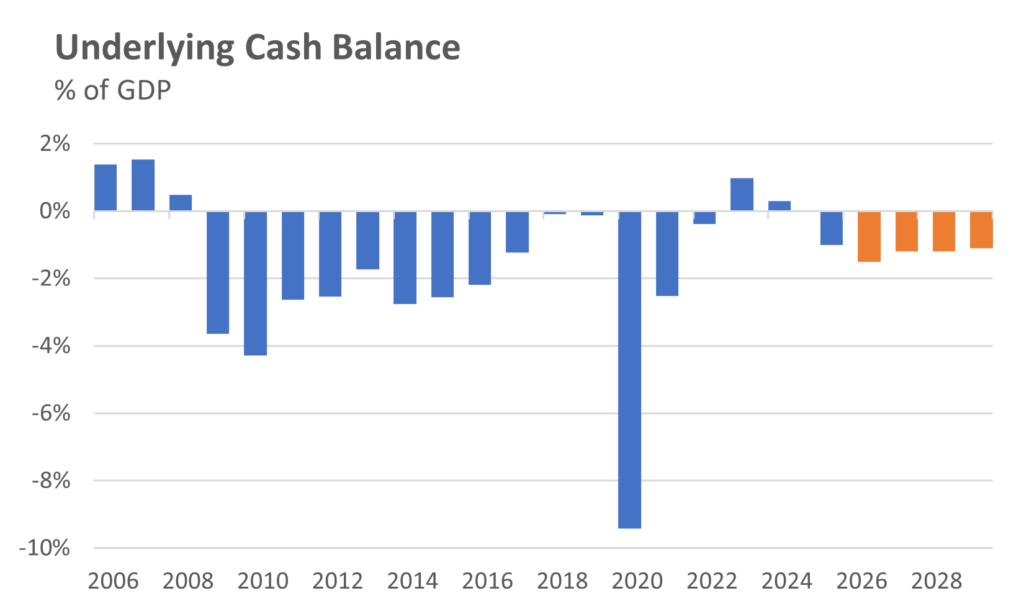

The 2024-25 Financial Year (FY25) is predicted to end with a fiscal deficit of 1%, as had been expected. This follows two years of small surpluses, as the chart below shows. The deficit for FY26 is slightly larger than most analysts had expected at nearly 1.5% of Gross Domestic Product (GDP). As a point of comparison, the US fiscal deficit for 2025 is likely to be around 6% of GDP.

This small increase in the fiscal deficit presents incremental fiscal impulse, which provides modest support for economic growth in FY26. Our view is that this is unlikely to have much of an impact on inflation.

Source: LSEG Datastream, Australian Treasury March 2025. Orange bars reflect Treasury projections.

Net debt is expected to rise from 19.9% of GDP in FY25 to 23.1% of GDP in FY29. This is slightly higher than had been anticipated in the Mid-Year Economic and Fiscal Outlook. However, this is still quite low compared to international peers and so Australia’s credit rating is likely to be reaffirmed.

The real focus now turns to the election, which must be held before 17 May. The latest polling figures indicate that it is going to be a very close outcome. Two party preferred polling has the Coalition at 51% and the Australian Labor Party (ALP) at 49%.

What the budget means for the Australian economy

The economic assumptions embedded in the Budget are generally consistent with the views of the Reserve Bank of Australia (RBA). Growth is expected to be trend-like over the next year and then improve in FY27. Inflation is expected to be consistent with the RBA inflation target.

Household consumption is expected to pick up over the next 12 months. Whilst we think this is appropriate, there are risks to the rebound not being as strong if global uncertainty remains elevated. Additionally, it is possible that the interest rate cuts do not provide as much of a boost if households prefer to maintain mortgage payments and thus reduce their debt.

Watch for two key risks

Two key risks to the Australian outlook and Budget are risks of an escalation in global trade tensions and a large slowdown in the Chinese economy. The key watchpoint for these risks are the assumptions around the Australian dollar and the iron ore price. On the latter, the Budget assumptions are generally conservative. Iron ore is currently trading at $104 per tonne, with the Budget assuming prices of $60 per tonne over the forward horizon. This should provide a healthy buffer from Budget downgrades if commodity prices fall.

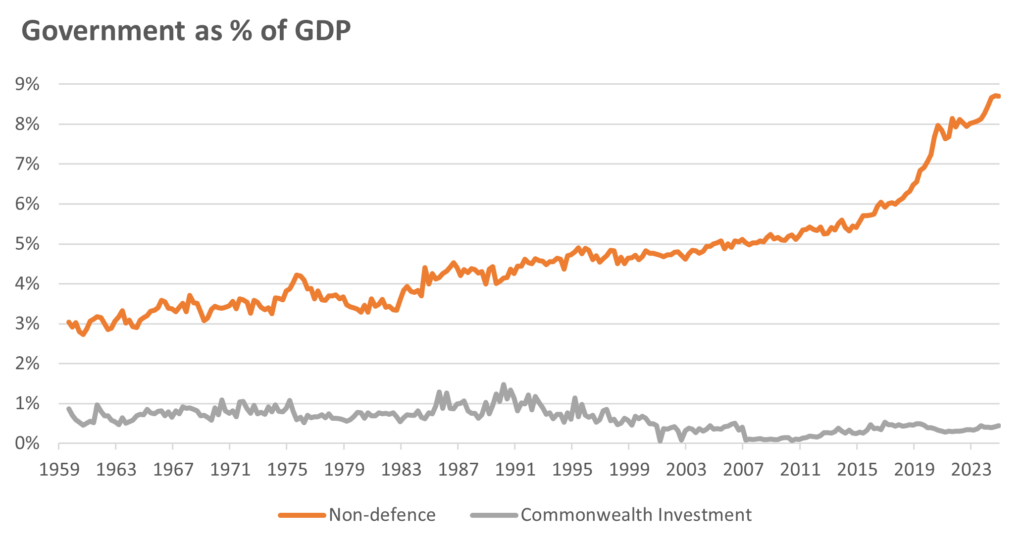

The structural challenges of the Budget remain, with deficits expected out to the horizon. Thus far, the opposition has not announced any concrete plans on how to improve this situation. The chart below shows Government consumption and Commonwealth Investment as a percent of GDP, which has been rising since the end of 2009. Over the medium term, this is unsustainable—but in the shorter term, it provides support to the economy. The Budget forecasts that public demand will grow faster than private demand through FY26, after which private demand will outpace it.

Source: LSEG Datastream, Australian Bureau of Statistics

Implications for portfolios

We believe this Budget has limited consequences for investment markets this year, given the domestic uncertainty around the pending election and the global uncertainty around trade policy.

The tax cuts for consumers are not set to kick in until July 2026 and are not likely to have a major impact on consumer spending—especially when the savings rate is already quite low.

Our multi-asset portfolios are generally overweight Australian fixed income relative to overseas. Whilst there are structural deficit challenges, we do not think this Budget presents upside risk to interest rates—especially given the deficit challenges of international peers. Australian government bonds are attractively valued and will provide a buffer if we see more volatility in the global economy.

We have a small preference for international equities relative to Australian equities—this budget doesn’t change that. The fiscal impulse (i.e. the impact to economic growth from fiscal spending) is very similar to what was previously expected. Additionally, corporate earnings are expected to be stronger outside Australia.

Finally, we think that the Australian dollar has upside, and this Budget has not hindered that. The Australian dollar looks attractive on valuation terms, while interest rate differentials should start to improve. Potential stimulus from China could provide further support.

What the Budget means for superannuation

There were no new announcements in the Budget made in relation to superannuation. It remains to be seen whether there will be any changes proposed by either side in the upcoming election.

There was no word on the previously proposed additional tax on balances above $3 million that has since stalled in the Senate.

Existing changes from 1 July 2025

With no amendments announced in the Budget, the following changes will occur as scheduled from 1 July 2025:

· The Superannuation Guarantee rate will increase from 11.5% to 12% (with no further legislated increases for future years).

· The Government will pay superannuation on Commonwealth Government-funded Paid Parental Leave (PPL) for parents of babies born on or after 1 July 2025, with the payments made annually to individuals’ super fund accounts from 1 July 2026.

The Australian Taxation Office (ATO) recently released details of the various thresholds that will apply for FY26:

· The general Transfer Balance Cap (the maximum a person can transfer to a tax-free pension product) will increase from $1.9 million to $2 million. It is indexed to the Consumer Price Index (CPI) in increments of $100,000.

· The contributions caps will not increase—the concessional contributions cap will remain at $30,000 and the non-concessional contributions cap will remain at $120,000 (four times the concessional cap). The concessional contributions cap is indexed to wages (Average Weekly Ordinary Time Earnings or AWOTE) in increments of $2,500 and increased last year.

If passed in Parliament in its current form, Payday super will go ahead as planned from 1 July 2026. The draft legislation is currently open for consultation.

Additional funding to bolster tax integrity

The Government announced additional funding to the ATO to strengthen the fairness and sustainability of Australia’s tax system.

This includes $50 million over three years from 1 July 2026 to extend the Tax Integrity Program to enable the ATO to ensure timely payment of tax and superannuation liabilities by businesses.

Cost-of living relief measures

The Government announced a number of cost-of-living relief measures, which impact household budgets and therefore could affect decisions relating to super contributions, retirement and drawing down income in retirement. The proposed measures include:

- Income tax cuts – From 1 July 2026, the 16% tax rate (which applies to taxable income between $18,201 and $45,000) will be reduced to 15%. From 1 July 2027, this will be further reduced to 14%. For individuals with a reduced marginal tax rate, this may reduce the tax benefit from making voluntary concessional (or pre-tax) superannuation contributions and so there may be an advantage in considering bringing forward these contributions.

- Power bill relief – The Government has proposed extending the $75 per quarter rebate for every household and eligible small business for another two quarters to December 2025.

- Cheaper medicines – From 1 January 2026, a reduction in the maximum PBS patient co-payment for Medicare card holders from $31.60 to $25. The previously announced five-year freeze for pensioners and other concession cardholders at $7.70 per script will continue.

- Higher Education Loan Program (HELP) relief – The Government will cut $19 billion in student HELP debt via a 20% reduction in current debts and previously announced changes in indexation rules.