Your 2021-22 annual statement is on the way

We’re putting the final touches to your 2021-22 annual statement and expect most members to start receiving their statements in mid-September. In the meantime, here’s more information on what’s happening and what to expect.

When will you receive your statement?

Most members will receive their 2021-22 annual statement from the mid-September to October period.

How can you access your statement?

If you’ve given us a valid email address, you will receive an online statement. We’ll send you an email to let you know when it’s ready. You simply need to log in to your online account and go to My Account > Communications to download your statement.

- Not sure how to log in? You will need your member number and password to log in to your online account.

- Can’t remember your password? No problem—just re-set it.

You can also use the Super Tracker App to access your statement.

If we don’t have a valid email address for you, you will receive your statement via the post. Importantly, it will also be available online, so why not make the switch to online today? It also means you get 24/7 access to your super, and you can take action easily, hear from us more often and save on paper too !

What to expect in your statement?

You will see all the key aspects of your super and retirement account in one document:

- Key highlights

- Account history

- Investments at a glance

- Investment returns

- Insurance benefits and beneficiaries

- Transaction history

- Fees and costs summary

We also have a handy guide on how to interpret and make the most of your statement.

Your investment returns

As your super fund, we invest your super money on your behalf with the aim of growing your super balance over the years to retirement. Because your super stays invested until you retire—and even beyond—it’s clearly a long-term investment.

As with any investment, your super is not immune to volatile markets, global events and economic shifts. And we saw all of this in the 2021-22 financial year. It came in the form of an economic slowdown in China, supply chain issues, a prolonged Russia/Ukraine conflict, rising inflation, recession fears and aggressive central bank responses via interest rate increases.

All this left its mark on investment markets, and you can expect to see this reflected in your own super returns as you go through your annual statement for 2021-22. Many of the super and retirement investment options show single-digit negative returns, compared to the previous financial year which had double-digit positive returns.

But you’re not alone in this.

Negative returns over the 2021/22 financial year have been experienced across the industry. In fact, research house Chant West reports negative median returns for all categories from conservative, right through to high growth.1

Want to get a better handle on what drove 2021-22 super fund returns? We took a closer look.

An eye to the long term

It’s often said that past performance is not an indicator of future performance. However, analysing past performance can help with understanding long-term trends and how we expect markets to behave. Sometimes it helps to ‘zoom out’ and observe the bigger picture to put things into perspective.

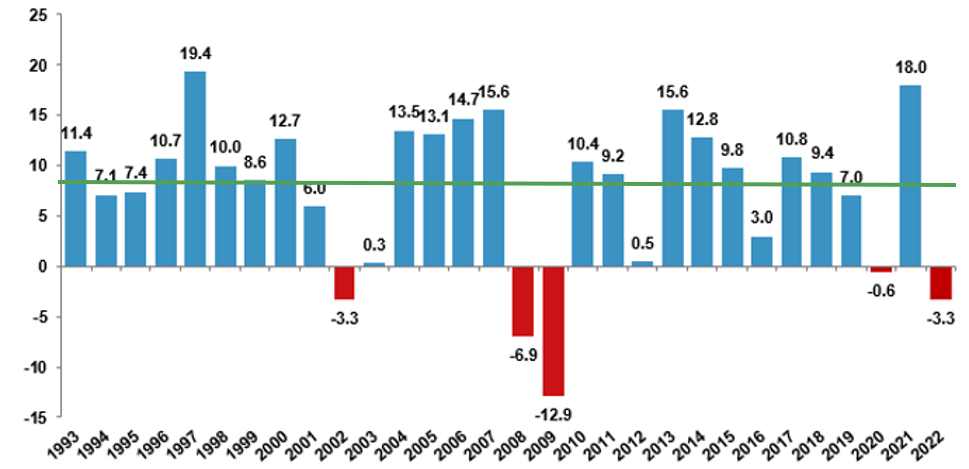

Looking at super performance over the past years shows why it’s important to take a step back from any disappointment you feel about the 2021-22 returns. As the Chant West chart below shows, the negative return for 2021-22 represents only the fifth negative year in the full 30 years of compulsory super. Over this period, returns have averaged 7.9% p.a.2

Growth Funds – Financial Year Returns (%)

Note: Performance is shown net of investment fees and tax. It does not include administration fees. Past performance is not a reliable indicator of future performance. Source: Chant West

Annual super returns will continue to go up and down in response to major global events and market volatility. History has shown that markets bounce back, events resolve, and trends come and go. What’s clear is that negative returns in any given year are rare, but it’s part of the normal investment process. Where it counts, the long-term average is well above CPI and produces a solid result for its intended time frame (i.e. through to retirement).

It’s also worthwhile noting that many super funds are sending out annual statements at the moment, so there’s a lot of talk about performance. Don’t let the noise distract you, because how you measure performance can vary. What gives the greatest level of clarity about how your investments have done depends on your own retirement income goals and timeframes, and personalised investment strategy. While it’s tempting to compare, take a moment to think about how another fund might be positioning their performance. Focus on what matters to you and where you’re headed.

Focus on GoalTrackerTM – the MySuper option

Let’s look at the performance of our MySuper investment option, GoalTracker. The MySuper option is generally considered a fair measure, as it’s built on the principle of providing a simple, cost-effective and balanced product to members invested in a default investment option.

Similar to 2021-22 industry super returns, GoalTracker also experienced negative returns. However, as the table below shows, although GoalTracker returns were negative in the last financial year, there was double-digit growth the year before. Plus, over the two years since its launch, the average returns are positive.

| Age | GoalTracker 1-year performance to 30/6/2021 | GoalTracker 1-year performance to 30/6/2022 | GoalTracker annualised performance since inception (28/3/2020 to 30/6/2022) |

| 30 | 24.5% | -6.5% | 9.9% |

| 40 | 24.5% | -6.5% | 9.9% |

| 50 | 24.5% | -6.5% | 9.9% |

| 55 | 20.9% | -6.0% | 8.6% |

| >60 | 17.3% | -5.5% | 7.2% |

Source: Russell Investments. Past performance is not a reliable indicator of future performance.

And while it helps to be patient and understand the nature of volatility, what’s critical is an investment strategy tailored to your age, personal circumstances and retirement goals. If you want help to work this out, please call us on 1800 025 241.

Proven expertise

As a leading global investment manager with over $435 billion in assets under management (as of 30 June 2022), Russell Investments is well positioned to manage and invest your super money. As a Nationwide Super member, you’re tapping into the same highly rated, award-winning global investment expertise as many of the world’s largest investors.

Our investment approach is focused on the long term. There is a global team of economists, strategists, analysts and portfolio managers that have steered investors worldwide through many market cycles and volatile events. They are well prepared to manage your money in all market conditions.

Future outlook

Let’s end on a positive note.

The Australian Prudential Regulation Authority (APRA) recently released the results of its annual Performance Test, now in its second year. And for the second year in a row, GoalTracker, which is the MySuper Investment Option for the Russell Investments Master Trust, has passed this test.

And the new financial year is off to a great start with a bounce back of super fund returns thanks to a sharp rebound in share markets—the median growth fund in the industry surged 3.1% p.a. in July3. The GoalTracker performance across the different age bands for July did even better, ranging between 3.51 to 4.43% p.a.

It’s a timely reminder to us all to stay the course and focus on the long term.