Important Changes to Nationwide Super – Russell Investments

To ensure we continue to provide a competitive super and pension offering to our members, the Trustee of Nationwide Super has decided to enter into an alliance with Russell Investments. These changes will offer an immediate fee reduction, and additional product features and services to our members from 1 December 2018.

Click below to download the relevant pdf version of the ‘Important Notice to Members’ regarding the alliance with Russell Investments.

Significant Event Notice – Super members Significant Event Notice – Pension membersFurther details about the transfer, including Frequently Asked Questions are below:

About the alliance with Russell Investments

NSF Nominees Pty Ltd, the Trustee of Nationwide Super has been looking to the future over recent times to ensure we continue to provide the best possible outcomes for our members and employers. This includes assessing the increasing costs and obligations due to changes within the super industry that have occurred, or are likely to occur in the near future.

Following extensive investigations and assessments, the Trustee Board has decided that our members’ interests are best served by entering into an alliance with Russell Investments.

The aim of the arrangement is to benefit from the economies of scale, value for money, security and expertise that Russell Investments can provide. Transitioned members will benefit from the following enhancements:

- An immediate fee reduction for Super members. This means you’ll be paying less administration and investments fees per annum.

- Access to a wider range of investment options. You’ll have access to 23 investment options and global investment opportunities that weren’t previously available.

- Improved suite of tools and services – to help you better manage your super savings.

This decision will also see the Nationwide Super brand maintained, along with our commitment to be the Small Business Super Business – supporting members and employers who work in and run small businesses right around Australia.

Russell Investments is a global investment manager, dedicated to improving financial security for people for more than 80 years. They guide more than $3 trillion and manage over $390 billion¹ on behalf of many of the largest global investors and individuals around the world.

¹As of 30 June 2018.

Find out more about Russell Investments.

The Trustee of Nationwide Super will be transferring member accounts to Russell Investments by way of a Successor Fund Transfer (SFT).

An SFT is a transfer of the members in a superannuation fund to a different fund (successor fund) without the consent of those individual members.

To be legally allowed to transfer member accounts by an SFT, members must receive equivalent rights and that overall the transfer is in members’ best interests. The Trustee of Nationwide Super has gone through a process of due diligence and is confident that members will not lose benefits as a result of the transfer.

From 1 December 2018, the new Trustee of Nationwide Super will be Total Risk Management Pty Ltd, which is part of the Russell Investments group of companies.

Information for all Nationwide Super members

The transfer of Nationwide Super member accounts to Russell Investments will take place on 1 December 2018.

Below are some frequently asked questions that apply to all Nationwide Super members.

You don’t have to do anything – we will transfer your account for you.

After the transfer, you will receive an Information Kit with a link to the Product Disclosure Statement for the Nationwide Super plan in the Russell Investments Master Trust – this will contain detailed information about your account and the additional product features and services that will be available to you.

A final statement from Nationwide Super will be issued by early 2019. The statements will cover the period 1 July 2018 – 30 November 2018.

We’re confident that the transfer is the right thing to do for our members, but we understand not everyone will be comfortable with the change. If you don’t want your account transferred, you will need to roll your super benefit out of Nationwide Super to a new super fund of your choice or if eligible (restrictions apply), withdraw your Nationwide Super benefit. If you choose to roll out or withdraw your super from Nationwide Super, you need to ensure we receive your completed request and any required paperwork before Friday 23 November 2018.

Yes. Any communication preferences you have previously indicated to Nationwide Super will continue to apply after the transfer takes place.

All primary communication with you will continue to be delivered electronically by default if we have a valid email address for you, and/or pending any election by you to receive print communications.

Non-binding death benefit nominations

If you have made a non-binding (preferred) death benefit nomination, after the transfer this will still be valid.

Binding death benefit nominations

If you have made a binding death benefit nomination, after the transfer this will be treated as a non-binding (preferred) death benefit nomination until such time as you make a new binding death benefit nomination.

If you want a binding beneficiary nomination to apply to your Nationwide Super account after the transfer, you will need to complete and return a new Binding Beneficiary Nomination form after 1 December (available from our website).

We will endeavour to finalise these matters prior to the transfer date. However, where this cannot be achieved, the matters will be transferred to the new Trustee for handling and processing as soon as possible after the limited processing period ends.

Yes. You will be able to access the services provided by Retire360. Retire360 can offer you a personal recommendation on a single issue related to your super, over the phone. Nationwide Super will cover the cost of this advice on your behalf.

If you are looking for more complex or comprehensive advice that takes into consideration investments outside of super, then Retire360 can work with you to produce a financial plan. Your first meeting is complimentary, with a fee-for-service model applying for your financial plan. Any costs will be discussed with you in advance.

Neither MUFG Retire360 Pty Ltd nor its employees are representatives of Total Risk Management Pty Ltd, the new Trustee of Nationwide Super from 1 December 2018. As per the current arrangements, no commissions are paid by any party to any other party, for referring Nationwide Super members to MUFG Retire360 Pty Ltd. Total Risk Management Pty Ltd will not accept liability for any loss or damage incurred by anyone using Retire360 products or services.

Information for Super members

(Employer Sponsored Division and Personal Division)

What is changing with your account?

From 1 December 2018, your investment option values will be unitised. This means that your account balance will also be displayed in units. Investment returns will be passed on to your account via the calculation of unit prices (usually daily) for the investment option/s you have chosen. Refer to the ‘Changes to Investments’ section for more details.

BPAY details for making voluntary personal contributions to your account will change from 1 December 2018. Please delete any old BPAY details you have saved in your internet banking account.

BPAY Biller Code (unchanged): 200089

Customer Reference Number (CRN): Your new CRN will be provided in your Welcome Information Kit, or can be obtained in MemberAccess from mid-December, or by contacting the Nationwide Super team.

® Registered to BPAY Pty Ltd ABN 69 079 137 518

Third Party Authorities will not be transferred and will not apply after the transfer date. You will need to complete and return a new Adviser Details form or third party authority letter after 1 December. You should contact your adviser to arrange this.

What is not changing with your account?

Yes. You can continue to contact us by:

Phone: 1800 025 241

International: +61 2 8571 6855

Email: enquiries@nationwidesuper.com.au

Postal Address: Locked Bag 5215. Parramatta NSW 2124

Website: nationwidesuper.com.au

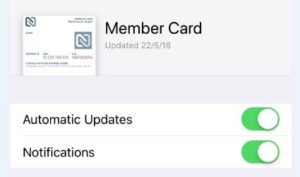

You can continue to use your Digital Member Card. However, there are a few details about Nationwide Super that are changing, including the Fund ABN and USI. If you don’t already have the ‘Automatic Updates’ button set to green (see image below), please switch it to the green setting prior to 30 November 2018, otherwise you will need to delete and re-upload the card again via our website, after 1 December 2018.

Your Nationwide Super Member ID will not be changing, and all of your personal details including name, address, date of birth and Tax File Number (TFN) will not need to be updated or supplied again.

If you haven’t already supplied your TFN and wish to do so, this should be done before Friday 23 November 2018. Otherwise, after the transfer we cannot refund any No TFN tax you have paid within the last three years.

The online MemberAccess service that allows members to managing their super savings from a computer or mobile device will still be available. There will be no need to register again for this service and your login details and password will stay the same.

You will notice a number of additional tools and functions in MemberAccess after 1 December, and the service will continue to be improved over time.

Also known as SuperMatch consent, if you have previously provided consent for Nationwide Super to use your TFN to search for any lost super you may have via the Australian Taxation Office (ATO), including to transfer any lost super amount held by the ATO to your Nationwide Super account, that consent will transfer to Total Risk Management Pty Ltd unless you tell us otherwise.

Powers of Attorney will be transferred and will continue to apply after the transfer date. If you have a Power of Attorney in place on your account, you do not need to do anything.

New Fees and Costs

The fees and costs applicable to your Nationwide Super account will be different after the transfer. As always, fees will vary depending on your account balance and investment options. The good news for all members is that the combination of administration and investment fees will result in a reduced total of fees payable per annum. We have included a fee comparison example to show you the difference in fees payable for different account balances.

It is worth noting that while the administration fee will be structured differently and be higher than your current fee, this will be more than offset by the much lower investment and indirect fees and costs, resulting in an overall lower fee amount.

A comparison of the fees payable on a $50,000 account balance in the MySuper Investment Option is shown below:

| Current Nationwide MySuper / Diversified Investment Option with $50,000 balance | New MySuper Investment Option with $50,000 balance |

| Administration Fee $130 p.a. | Administration Fee $78 p.a.

and 0.294% p.a. |

| Investment Fee 0.00% p.a. | Investment Fee 0.36% p.a. |

| Indirect Costs of 1.63% p.a. | Indirect Costs 0.29% p.a. |

| Total fees = $945 | Total fees = $550 |

The table below shows a comparison of Fees and Costs for Nationwide Super, between the Current Fees and the Fees and Costs effective from 1 December 2018:

| Fee type |

Current amount | New amount |

| Administration Fee | $130 p.a. | $78 and 0.294% p.a. |

| Investment Fee | 0.00% p.a. | Varies – see Indirect Cost Ratio below |

| Indirect Cost Ratio | MySuper / Diversified – 1.63% p.a. High Growth – 1.52% p.a. SRI / Ethical – 1.55% p.a. Prudent – 1.16% p.a. Cash – 0.74% p.a. |

MySuper – 0.65% p.a. High Growth – 0.94% p.a. Ethical equivalent – 1.07% p.a. Defensive – 0.69% p.a. Cash – 0.24% p.a.This is the combined Investment Fee + Indirect Costs per option. The amounts are not deducted from your account but are included in the valuation of each option, and reduces investment returns. |

| Buy-sell Spread |

Nil | Varies – see russellinvestments.com.au/iqbuysellspread for full details. Diversified options, including My Super, have a nil buy-sell spread for the first 5 investment switches in a financial year. Thereafter it is 0.20% of the switched amount. Other investment options have varying buy-sell spreads (Nil for Cash). |

| Switching Fee | First request each financial year = Free 2nd and subsequent request = $35 |

You will no longer be charged a Switching Fee. Refer to Buy-sell spread details above. |

| Exit fee | $70 | $99.12 |

| Advice Fees | Per activity | Nil for general and simple personal advice related to your interests in the Fund. An advice fee for complex personal advice may be payable. |

| Other fees and Costs1 | Per activity | Nil |

1 – Refer to ‘Additional Explanation of Fees and Costs’ section of the Member Guide for details of these other fees.

| Fee type | Current amount | New amount |

| Information Request | $52 | $150 |

| Account Splitting Fee | $103 | $150 |

| Payment Flagging Agreement | Nil | Nil |

Investment Options

Nationwide Super currently has 5 investment options available for members. Under the new arrangements, members will have access to 23 investment options.

As part of the transfer, we will match your current investment option/s to the equivalent investment option/s from the available suite. While most current investment options have an obvious equivalent, or ‘like for like’ option in the new suite (including the MySuper ‘default’ option), the Nationwide Ethical option will be split between 4 new investment options as detailed in the table below, to ensure those members receive a ‘like for like’ option.

The below table shows the current investment option and investment costs, as well as the ‘like for like’ investment option/s your super savings will be moved to as part of the transfer.

| Current Investment Option | Total Investment Fees | Investment Fees + Indirect Costs | New Investment Option | Total Investment Fee | Investment Fees + Indirect Costs |

| Nationwide MySuper/ Diversified | 1.63% p.a. | 0.00% + 1.63% p.a. | MySuper | 0.65% p.a. | 0.36% + 0.29% p.a. |

| High Growth | 1.52% p.a. | 0.00% + 1.52% p.a. | High Growth | 0.94% p.a. | 0.64% + 0.30% p.a. |

| SRI/Ethical | 1.55% p.a. | 0.00% + 1.55% p.a. | 35% – Responsible Australian Shares

35% – Responsible Global Shares 15% – Australian Fixed Income 15% – Global Fixed Income |

0.96% p.a. | 0.87% + 0.09% p.a. |

| Prudent | 1.16% | 0.00% + 1.16% p.a. | Defensive | 0.69% p.a. | 0.48% + 0.21% p.a. |

| Cash | 0.74% p.a. | 0.00% + 0.74% p.a. | Australian Cash | 0.24% p.a. | 0.16% + 0.08% p.a. |

From 1 December 2018, you will have access to 23 investment options and global investment opportunities that weren’t previously available.

More information about these new investment options will be available after 1 December 2018

Currently, investment earnings are calculated and allocated to members accounts on a yearly basis, effective as at 30 June each year. An interim rate of earnings is also calculated weekly (based on net returns to date and an allowance for an estimate of tax and expenses), and is applied to any withdrawals or investment switches throughout the year.

Under the new arrangements, investment option values will be unitised. This means that investment returns will be passed on to your account via the calculation of unit prices (usually daily) for the investment option/s you have chosen. As per the current arrangements, unit prices can go up or down. This means the investment returns may be positive or negative.

Currently, you can switch your investment options using MemberAccess or by submitting a Member Investment Choice form. Any investment switches you make are not effective immediately. Investment switches are processed on Saturdays each week, after crediting rates are updated. Where your switch request is submitted by Tuesday midnight, the effective date will generally be the following Saturday with the crediting rates current at that time being applied to the investments you have switched out of. Also, you can currently make 1 free switch each financial year, with a $35 fee payable per subsequent switch.

From 1 December, you will be able to make investment switches via the same process, but you can make switches daily if desired. You will also have the flexibility to choose a different option or mix of options for your future contributions versus the balance you have already accumulated. Any deductions from your account will come from the option(s) you have selected for future contributions. Your new investment choice will generally take effect two business days after we receive the request. This means the unit prices will reflect the investment returns on the day of your request, and transactions will be processed and units allocated to your account on the same day.

Rather than a flat Switching Fee, the pricing structure under the new arrangements is known as a Buy-Sell Spread. The Buy-Sell Spread varies depending on your investment option/s. Please see the Comparison of Fees and Costs table above for details of the Buy-Sell Spread costs.

Under the new arrangements, buy/sell spreads apply to your investment options.

Generally, a buy/sell spread is a fee you may pay every time you make a transaction, including making a super contribution, an investment switch or a withdrawal. It covers some or all the cost of each transaction entered by the fund.

With investment options, a buy/sell spread is the estimated transaction cost incurred by the fund when buying or selling underlying assets. The buy/sell spread is used to calculate the entry and exit prices for a specific investment option, when you invest, redeem or switch investment options.

Different investment options have different buy/sell spreads. However, it’s worth noting that typically there is no buy/sell spread for the diversified options (listed below), unless you make more than five investment switches in a financial year. And if you do, then you’ll incur a buy/sell spread of 0.20% of the switched amount.

- MySuper

- High Growth

- Growth

- Blended Balanced

- Balanced

- Diversified 50

- Defensive

Russell Investments buy-sell spreads is available here.

Insurance Cover

The current arrangements with regards to insurance within your Nationwide Super account will remain unchanged. The policies held with CommInsure will transfer from NSF Nominees Pty Ltd to the new Trustee of Nationwide Super, Total Risk Management Pty Ltd.

Any default or additional cover you currently hold will remain in place following the transfer and there is nothing you need to do as a result.

Please refer to the ‘Limited processing period’ section for details of any impacts to new applications for additional cover or changes to existing cover over the transfer period.

You will still be able to manage your Insurance cover online via your MemberAccess account, but this functionality will be somewhat limited until early 2019. In the meantime, some insurance applications or processing may need to be completed by submitting forms that you can obtain from our website or by calling 1800 025 241.

We will attempt to finalise any insurance claims currently in progress prior to the transfer date. However, where completion has not been finalised prior to 27 November 2018, the claim will be transferred for completion after the limited service period. We will be working to ensure minimal disruption for members and claimants.

Whilst the cost of insurance is not changing, the way insurance premiums are deducted from your account will change from 1 December 2018. Currently, premiums are deducted on a before-tax basis, and a 15% tax rebate on the premiums is applied separately to your account on a monthly basis. From 1 December, premiums will be deducted on an after-tax basis, meaning they will be 15% less than your current deduction, however no separate tax rebate will apply. The overall cost of insurance is therefore not changing.

Other Important Information

There will be a limited processing period before and after the transfer. Any requested transactions will be completed as quickly as possible after the limited processing period ends. However, they may take a little longer than usual to be completed.

The table below details the types of transactions that will be affected and the final dates for processing prior to the transfer.

| Transaction type | Details | Deadline prior to transfer |

| General account updates, insurance changes or claims | This will be the last day your account can be updated. These updates include: changes of your personal details, beneficiary nominations, third party authority, power of attorney, SuperMatch consents etc.

This will also be the last day we can process your insurance requests and changes to insurance. |

Tuesday 27 November 2018 |

| Using MemberAccess | MemberAccess will not be available during the limited processing period. You will not have access to your account details or be able to complete any online functions during this period.

MemberAccess will become available mid-December 2018, and you will be able to log-in using your current log-in details (including password). |

Tuesday 27 November 2018, 5pm (NSW time) |

| Investment switches | This is the last day you will be able to submit an investment switch for processing prior to the transfer. | Tuesday 20 November 2018 before midnight |

Financial transactions, including:

|

There will be limited processing of all financial transactions, including rollovers in and out of the fund as well as all types of contributions to your account (including employer contributions, personal contributions and/or spouse contributions).

It is important to ensure you submit your rollover requests or pay contributions as soon as possible to ensure no delay. |

Friday 23 November 2018 |

| New pension account opening | All Nationwide Super pension accounts will be transferred to Russell Investments iQ Retirement. Any member wanting to open a new pension account should refer to the Product Disclosure Statement and Application Form at russellinvestments.com/au/retirementpds | New pension applications will not be processed from 24 October 2018. |

After your benefits have been updated with Nationwide Super’s final crediting rates at 30 November 2018, there will be a small percentage of unallocated funds (expected to be less than 1% of Nationwide Super’s assets) transferred across to Russell Investments, which represent the Fund’s:

- provisions for tax;

- accrued expenses relating to the wind-up of the Fund; and

- Operational Risk Financial Requirement (ORFR).

The ORFR has been maintained by the Trustee since 1 July 2012 and its purpose is to be used as a financial resource to address losses arising from any operational risks that may arise from time-to-time. Russell Investments does not require the Fund’s ORFR to be transferred into Russell Investments ORFR. As such, to the extent that the accumulation component remains available, it will be returned to members as part of the final allocation.

After the audit of the Fund’s financial statements has been completed, the Fund’s final tax return lodged, and all expenses associated with the Fund’s wind-up paid, the Fund’s net financial position will be determined. The remaining unallocated amount held (if any) will be available for allocation to current members of Nationwide Super who transferred to Russell Investments on 30 November 2018, and have remained in the Fund.

If any funds are available for distribution to members this will be loaded to your account and appear on your transition history online or on your annual statement.

Please note that any members that exit Nationwide Super before the allocation exercise is completed will forego any additional allocation, and that any payment of small amounts may be subject to a materiality test.

Information for Pension members

(Pre-Retirement Pension and Pension accounts)

What is changing with your account?

To ensure we continue to provide our members with a competitive pension product, the Trustee of Nationwide Super has decided to transfer all pension accounts to the Russell Investments iQ Retirement product. This change means members will benefit from the economies of scale, value for money and expertise that Russell Investments can provide.

As a result of this transfer, you will cease to be a member of the Nationwide Super Pension Division.

You don’t have to do anything. We will transfer your account for you, which will occur on 1 December 2018.

Your new iQ Retirement account will operate in a different way to the Nationwide Super Pension Division. For more information about iQ Retirement, including the Product Disclosure Statement, visit russellinvestments.com/au/retirementpds.

Once the transfer has occurred, you will receive a Welcome Letter from Russell Investments Master Trust, which will provide you with more detailed information about your iQ Retirement account and new product features and services that will be available to you.

In the New Year, you will receive an Exit Statement from Nationwide Super.

If you have any concerns about the impact of these changes to your cashflow, please contact the Nationwide Super team before 15 November 2018 to arrange a one-off higher payment to occur on 22-23 November 2018.

| Current Pension Payment Cycle | What Will Happen | Next Pension payment (after November payment) |

| Fortnightly | Will move to Monthly payments, on the 15th of the month | 14 December 2018* |

| Monthly | Monthly payment date will be moved to the 15th of the month | 14 December 2018* |

| Quarterly, Half yearly, or Yearly | Cycle remains the same, but the payment date will move to the 15th of the month when they fall due | 15th of the month your usual payment falls due |

*As 15 December 2018 falls on a weekend.

Your other instructions for the payment of your pension, for example your selected payment amount (within the minimum and maximum pension income payment limits) and bank account details, will be carried across and applied to your new iQ Retirement account.

When choosing how much you receive from your pension account, you may have considered the minimum and maximum limits set by government legislation.

Here’s a reminder of the pension payment amount options for the Nationwide Super Pension Division:

| Payment Amount | Nationwide Super Pension | Nationwide Super Pre-Retirement Pension |

| Minimum | Yes. Depends on age (see ‘Minimum’ table below) | Yes. Depends on age (see ‘Minimum’ table below) |

| Maximum | X Not applicable as no maximum applies | Yes. Maximum payment limit of 10% of your balance per financial year |

| Other selected amount | Yes. Must be at least the minimum | Yes. Must be within the minimum and maximum limits |

If you did not make a choice, you will be receiving the applicable minimum level of payment.

Minimum: the table below shows the percentages (set by the Government) that are used to calculate the minimum pension income amount each financial year.

| Age | Minimum Annual Payment (% of account balance) |

| Under 65 | 4% |

| 65-74 | 5% |

| 75-79 | 6% |

| 80-84 | 7% |

| 85-89 | 9% |

| 90-94 | 11% |

| 95 or over | 14% |

The minimum and maximum pension income amounts are calculated based on your withdrawal balance as at 1 July each year, and rounded to the nearest $10.

These minimum and maximum payment requirements are required to be met each financial year.

As the transfer of your pension account to iQ Retirement is occurring during the financial year, your pension payment amounts may need to be pro-rated, or re-calculated, to ensure you satisfy these requirements in relation to your Nationwide Super pension account for the period 1 July 2018 to 30 November 2018, and your iQ Retirement account for the period 1 December 2018 to 30 June 2019.

The table below outlines how your pension amount will be determined, to ensure you satisfy the legislative requirements:

| Your Current Payment Amount | Impact on Payment from Nationwide Super for 2018/19 | Impact on Payment from iQ Retirement for 2018/19 |

| Minimum | Your minimum pension amount will be calculated for the period 1 July 2018 to 30 November 2018, based on your withdrawal amount as at 1 July 2018 (pro-rata amount).

The pension payment you receive in November 2018 may be increased to ensure you have received at least the pro-rata minimum amount prior to the transfer. |

Your new minimum pension amount will be calculated for the period 1 December 2018 to 30 June 2019, based on your transfer balance.

This may result in a change to the monthly pension payments you receive after 1 December 2018. If you receive your pension payments quarterly, half yearly or yearly, your remaining pension payment(s) for the financial year may be increased to ensure you have received at least the minimum pension amount. If you have already been paid your minimum pension amount as a yearly payment from Nationwide Super, you are still required to be paid the pro-rata minimum pension amount from your iQ Retirement account. This payment will be made in June 2019. |

| Maximum | Not applicable for Nationwide Super Pension

For Nationwide Super Pre-Retirement Pension: If you elected to receive the maximum pension amount yearly, and you have not yet received this pension payment, your minimum pension amount will be calculated for the period 1 July 2018 to 30 November 2018, based on your balance as at 1 July 2018, and paid to you on 23 November 2018, prior to the transfer. For non-yearly payment frequencies, the pension payment you receive in November 2018 may be increased to ensure you have received at least the pro-rata minimum amount prior to the transfer. |

A new maximum pension amount will be calculated based on 10% of your transfer balance as at 1 December 2018. This full amount will be paid to you by June 2019.

If you would like to draw less than the full maximum pension amount between 1 December 2018 and 30 June 2019, please contact Russell Investments to make changes to your iQ Retirement account after 1 December 2018 (please note that pro-rata minimum pension income limits still apply). |

| Specified Amount | If you have specified an amount to be received from your pension account per year, and you have not yet received this pension payment, this amount will be pro-rated for the period 1 July 2018 to 30 November 2018, and this pro-rata amount will be paid to you on 22-23 November 2018, prior to the transfer.

If this payment is less than the pro-rata minimum pension amount, calculated for the period 1 July 2018 to 30 November 2018, this payment may be increased to the pro-rata minimum pension amount. |

The balance of the specified amount will be paid to you in the period 1 December 2018 to 30 June 2019.

If this payment is less than the pro-rata minimum pension amount, calculated for the period 1 December 2018 to 30 June 2019, this payment will be increased to the pro-rata minimum pension amount. |

Examples

Minimum pension payment

Mary is age 63 and her withdrawal balance at 1 July 2018 was $200,000. As Mary didn’t make a choice when she commenced her Nationwide Super Pension, she receives the minimum amount each financial year. For the 2018/19 financial year, her minimum pension income payment amount is $200,000 x 4% = $8,000.

To ensure Mary satisfies the legislative requirements, she needs to have been paid $3,350 ($8,000 / 365 days x 153 days) from her Nationwide Super pension account by 30 November 2018. If Mary will receive less than this amount, her November 2018 payment will be increased to ensure Mary has been paid at least the minimum pension amount.

Mary’s pro-rata minimum pension amount for the period 1 December 2018 to 30 June 2019 will be calculated based on her transfer balance as at 1 December 2018.

Maximum pension payment

Tony is aged 60 and has a Pre-retirement pension and elected to receive the maximum payment limit as a single pension payment, payable in April 2019. Tony’s withdrawal balance at 1 July 2018 is $90,000, making his maximum pension amount for the 2018/19 year $90,000 x 10% = $9,000. Tony will receive a pro-rata minimum pension payment from his Nationwide Super pre-retirement pension in November 2018 of $1,510 (4% minimum x $90,000 / 365 days x 153 days).

Assuming Tony’s transfer balance as at 1 December 2018 is $95,000, his new maximum pension amount for the 2018/19 year is $95,000 x 10% = $9,500. Tony will receive a pension payment of $9,500 from his iQ Retirement account in April 2019.

Specified pension amount

Henry has selected to receive a yearly pension payment of $12,000, payable in February 2019. Henry will receive a pension payment from his Nationwide Super pension account in November 2018 of $5,000 ($12,000 / 12 months x 5 months). He will then receive a pension payment of $7,000 from his iQ Retirement account in February 2019. His pension payment in February 2019 may be increased to the pro-rata minimum pension payment, to satisfy this requirement for the period 1 December 2018 to 30 June 2019.

New Fees and Costs

The fees and costs applicable to your pension account will be different after the transfer to iQ Retirement. As always, fees will vary depending on your account balance and investment options. We have included a fee comparison example to show you the difference in fees payable.

It is worth noting that while the administration fee will be structured differently and be higher than your current fee, this will be more than offset by the much lower investment and indirect fees and costs, resulting in an overall lower fee amount.

A comparison of the fees payable on a $50,000 Pension account balance in the Diversified / Balanced investment option is shown below:

| Current Nationwide Diversified Investment Option with $50,000 balance | iQ Retirement Balanced Investment Option with $50,000 balance |

| Administration Fee $130 p.a. | Administration Fee $156.42 p.a. and 0.30% p.a. |

| Investment Fee 0.00% p.a. | Investment Fee 0.52% p.a. |

| Indirect Costs of 1.63% p.a. | Indirect Costs 0.26% p.a. |

| Total fees = $945 | Total fees = $696.42 |

The table below shows a comparison between the current Nationwide Fees and Costs, and the Fees and Costs of iQ Retirement effective from 1 December 2018.

The table assumes investment in the Diversified / Balanced investment option.

| Fee type |

Nationwide Super Pension Division | iQ Retirement |

| Administration Fee |

$130 p.a. |

$3 per week ($156.42 p.a.); and

0.30% p.a. on investments between $0 and $500,000. 0.15% p.a. on investments between $500,000 and $1,000,000. Nil on every dollar in excess of $1,000,000 |

| Investment Fee |

0.00% p.a. |

For Contribution and TtR investments 0.52% p.a. of your account balance.

For Pension investments 0.52% p.a. of your account balance. |

| Indirect Cost Ratio |

1.63% p.a of your account balance, which is comprised of: Estimated Indirect Costs of 1.32% p.a. Actual Performance Fees of 0.31% p.a. |

For Contribution and TtR investments 0.24% p.a. of your account balance, which is comprised of:

Estimated Performance Related Fee of 0.02% p.a. For Pension investments 0.26% p.a. of your account balance, which is comprised of: Estimated Performance Related Fee of 0.00% p.a. |

| Buy-sell Spread |

Nil |

Varies – see russellinvestments.com.au/iqbuysellspread for full details. |

| Switching Fee | First request each financial year = Free 2nd and subsequent request = $35 |

Nil |

| Exit fee | $70 | Nil |

| Advice Fees | Per activity | Nil for general and simple personal advice related to your interests in iQ Retirement. |

| Other fees and Costs |

Per activity |

Family Law fees are payable for information requests and for payment splits.

An advice fee for complex personal advice may be payable. |

For more information about fees and costs applicable to your new iQ Retirement account, please refer to the iQ Retirement Product Disclosure Statement.

Investment Options

Nationwide Super currently has 5 investment options available for members.

Under the new arrangements, members will have access to 23 investment options.

The below table shows the current investment option and investment costs, as well as the ‘like for like’ investment option/s your retirement savings will be moved to as part of the transfer.

| Current Investment Option | Total Investment Fees | Investment Fees + Indirect Costs | New Investment Option | Total Investment Fee | Investment Fees + Indirect Costs |

| Diversified | 1.63% p.a. | 0.00% + 1.63% p.a. | Balanced Opportunities | 0.95% p.a. | 0.57% + 0.38% p.a. |

| High Growth | 1.52% p.a. | 0.00% + 1.52% p.a. | High Growth | 1.00% p.a. | 0.64% + 0.36% p.a. |

| SRI/Ethical | 1.55% p.a. | 0.00% + 1.55% p.a. | 35% – Responsible Australian Shares

35% – Responsible Global Shares 15% – Australian Fixed Income 15% – Global Fixed Income |

0.98% p.a. | 0.87% + 0.11% p.a. |

| Prudent | 1.16% | 0.00% + 1.16% p.a. | Defensive | 0.72% p.a. | 0.48% + 0.24% p.a. |

| Cash | 0.74% p.a. | 0.00% + 0.74% p.a. | Australian Cash | 0.20% p.a. | 0.16% + 0.04% p.a. |

From 1 December 2018, you will have access to 23 investment options and global investment opportunities that weren’t previously available.

More information about these new investment options will be available after 1 December 2018.

Other Important Information

There will be a limited processing period before and after the transfer. Any requested transactions will be completed as quickly as possible after the limited processing period ends. However, they may take a little longer than usual to be completed.

The table below details the types of transactions that will be affected and the final dates for processing prior to the transfer.

| Transaction type | Details | Deadline prior to transfer |

| General account updates | This will be the last day your account can be updated. These updates include: changes of your personal details, bank account details, payment frequency, beneficiary nominations, third party authority, power of attorney etc. | Tuesday 27 November 2018 |

| Access to your pension account online | Pension MemberAccess will not be available during the limited processing period. You will not have access to your account details or be able to complete any online functions during this period.

Online access to your iQ Retirement account will become available mid-December 2018. New log-in details will be provided to you by Russell Investments. |

Tuesday 27 November 2018, 5pm (NSW time) |

| Investment switches | This is the last day you will be able to submit an investment switch for processing prior to the transfer. | Tuesday 20 November 2018 before midnight |

| Financial transactions, including:

pension payments including partial or full withdrawals |

There will be limited processing of all financial transactions, including pension income payments. | Friday 23 November 2018 |

If you are a customer of Centrelink or the Department of Veterans’ Affairs, you must advise them of this transfer and change of provider within 14 days. A Centrelink Schedule will be provided with your Welcome Letter from Russell Investments Master Trust.

If you have made a binding death benefit nomination, after the transfer this will be treated as a non-binding (preferred) death benefit nomination until such time as you make a new binding death benefit nomination.

If you have made a non-binding (preferred) death benefit nomination, after the transfer this will still be valid.

If you have made a reversionary beneficiary nomination, after the transfer this will still be valid.

If you have completed a third party authority for an adviser, after the transfer you will need to complete a new third party authority.

If you have made a power of attorney, after the transfer this will still be valid.

For enquiries on your Russell Investments iQ Retirement account, you can contact:

Phone: 1800 300 353

Email: iq@russellinvestments.com.au

As always, we suggest that you seek licensed financial advice before making any changes that may affect your objectives, financial situation or needs.